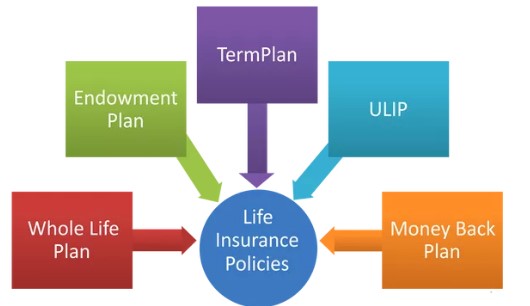

The purpose of life assurance is to supply money protection to living dependents when the death of AN insured. it’s essential for candidates to investigate their money scenario and verify the quality of living required for his or her living dependents before buying a life assurance policy. life assurance agents or brokers area unit instrumental in assessing desires and establishing the kind of life assurance most fitted to deal with those desires. many life assurance channels area unit on the market together with, whole life, term life, universal life, and variable universal life (VUL) policies. A lot of companies also offer many types of insurance postal life insurance is one of them.

Below are a number of the additional common varieties.

Term life insurance:

Is the most elementary, and sometimes least dear, type of insurance for folks beneath age fifty. A term policy is written for a particular amount of your time, usually one to ten years, and will be renewable at the tip of every term. Also, the premiums can doubtless increase at the tip of every term and may become prohibitively dear for older people.

Whole life insurance:

Combines permanent protection with a savings part. the policy gains worth, you will be able to borrow a little of your policy’s money worth tax free, though loans accrue interest and scale back the policy’s benefit and money worth, and will trigger a rateable event if the policy lapses. People also purchase Religare health insurance along with these ones.

Universal life insurance:

Is similar to whole life with the additional advantage of doubtless higher earnings on the savings part. Universal life policies are additional versatile in relation to premiums and face worth. Premiums is also multiplied, decreased, or postponed, and money values are often withdrawn. you will even have the choice to vary the number you’re insured for, called the face quantity. Universal life policies usually supply a guaranteed* come back on money worth. Premiums is also multiplied, decreased, or postponed, and money values are often withdrawn.1

Variable life insurance:

Generally offers mounted premiums and also the ability to take a position your money worth in an exceedingly selection of stock, bond, or cash market-based investment choices offered by your no depository financial institution. money values and death advantages will rise and fall supported the performance of your investment decisions.

Although death advantages sometimes have a floor, there’s no guarantee on money values. Fees for these policies is also over for universal life, and investment choices is also volatile. These investment choices are subject to promote risk together with loss of principal.